See This Report about Property By Helander Llc

See This Report about Property By Helander Llc

Blog Article

All About Property By Helander Llc

Table of ContentsNot known Details About Property By Helander Llc Not known Incorrect Statements About Property By Helander Llc The smart Trick of Property By Helander Llc That Nobody is Talking AboutOur Property By Helander Llc DiariesRumored Buzz on Property By Helander LlcThe Main Principles Of Property By Helander Llc

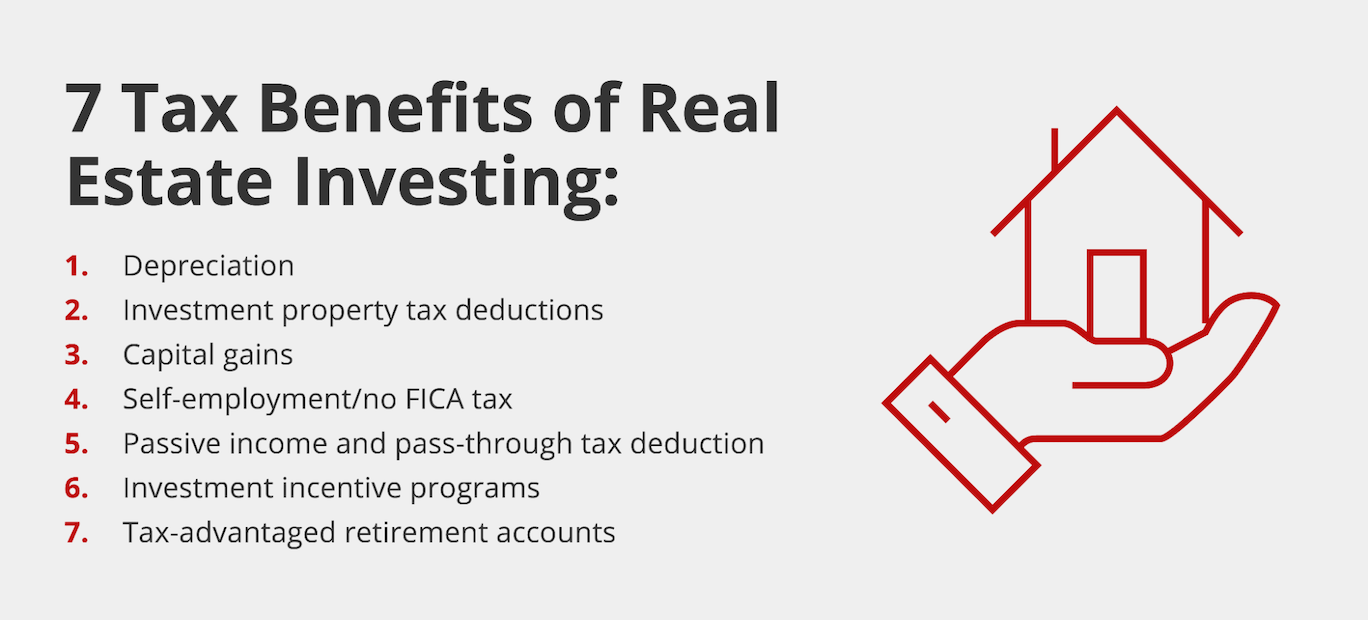

The advantages of spending in realty are various. With appropriate possessions, financiers can delight in predictable capital, superb returns, tax benefits, and diversificationand it's possible to take advantage of property to develop wealth. Thinking of investing in genuine estate? Here's what you need to learn about realty advantages and why property is thought about a great financial investment.The benefits of investing in property include passive revenue, steady cash money flow, tax benefits, diversification, and take advantage of. Genuine estate investment counts on (REITs) supply a method to spend in actual estate without having to have, operate, or finance residential or commercial properties - (https://profiles.delphiforums.com/n/pfx/profile.aspx?webtag=dfpprofile000&userId=1891238286). Money flow is the net earnings from an actual estate financial investment after home mortgage payments and overhead have been made.

In a lot of cases, capital just strengthens gradually as you pay for your mortgageand develop your equity. Genuine estate capitalists can make the most of many tax breaks and deductions that can save cash at tax obligation time. Generally, you can deduct the practical costs of owning, operating, and managing a property.

The Definitive Guide for Property By Helander Llc

Genuine estate values often tend to increase over time, and with a great investment, you can turn a revenue when it's time to sell. As you pay down a home home loan, you construct equityan asset that's component of your web worth. And as you develop equity, you have the utilize to purchase more homes and raise money circulation and riches also more.

Because property is a substantial asset and one that can offer as security, financing is easily available. Realty returns differ, depending upon aspects such as place, asset course, and monitoring. Still, a number that several investors intend for is to beat the average returns of the S&P 500what lots of people refer to when they state, "the market." The rising cost of living hedging capacity of realty comes from the favorable relationship in between GDP development and the demand genuine estate.

Not known Facts About Property By Helander Llc

This, in turn, translates right into greater capital values. Real estate tends to maintain the purchasing power of resources by passing some of the inflationary pressure on to renters and by incorporating some of the inflationary stress in the type of funding admiration - sandpoint idaho realtor.

Indirect genuine estate investing includes no straight ownership of a home or buildings. There are a number their explanation of ways that owning actual estate can protect against rising cost of living.

Ultimately, residential or commercial properties financed with a fixed-rate lending will see the relative quantity of the monthly home loan payments fall over time-- for circumstances $1,000 a month as a set settlement will certainly come to be less challenging as inflation erodes the buying power of that $1,000. Commonly, a main house is not considered to be a realty investment since it is used as one's home

Getting My Property By Helander Llc To Work

Despite having the aid of a broker, it can take a few weeks of work simply to locate the right counterparty. Still, property is an unique asset class that's basic to understand and can boost the risk-and-return profile of a financier's profile. By itself, property uses capital, tax breaks, equity structure, affordable risk-adjusted returns, and a bush versus rising cost of living.

Buying realty can be an unbelievably fulfilling and lucrative venture, but if you're like a great deal of new investors, you might be asking yourself WHY you must be buying realty and what advantages it brings over various other financial investment chances. In enhancement to all the impressive benefits that come along with spending in actual estate, there are some disadvantages you require to consider.

The Only Guide to Property By Helander Llc

If you're trying to find a way to purchase right into the realty market without having to invest thousands of hundreds of dollars, look into our properties. At BuyProperly, we utilize a fractional possession design that enables capitalists to begin with as little as $2500. An additional major advantage of property investing is the capability to make a high return from buying, refurbishing, and reselling (a.k.a.

The 9-Minute Rule for Property By Helander Llc

As an example, if you are charging $2,000 rental fee each month and you sustained $1,500 in tax-deductible expenses each month, you will just be paying tax on that particular $500 revenue per month. That's a huge distinction from paying taxes on $2,000 each month. The profit that you make on your rental device for the year is considered rental revenue and will certainly be taxed appropriately

Report this page